The Federal Reserve announced a significant interest rate cut of 50 basis points and hinted at an additional 50 basis points cut this year.

However, financial markets failed to maintain the upward trend following the announcement of the rate cut decision.

U.S. stocks surged and then fell back, with major stock indices turning negative during the trading session.

Gold prices rose by over 1% to a historical high before also turning negative, and U.S. Treasury bond prices fell, with the yields on U.S. Treasury bonds that had dived during the session turning positive.

The Federal Reserve announced its first rate cut in four years on Wednesday, with only one dissenting vote among the committee members against a 50 basis point cut.

The dot plot indicates that slightly over half of the decision-makers expect at least a 25 basis point cut at each of the remaining two meetings this year.

The resolution statement added a firm commitment to supporting full employment and greater confidence in reducing inflation to the target, changing the description of employment and inflation risks as broadly balanced, and noting that employment growth has slowed.

"The new Fed whisperer" commented that the cut exceeded the expectations of most analysts a few days ago, and the Federal Reserve has entered a new phase of fighting inflation, aiming to prevent further weakening of the labor market due to previous rate hikes.

The S&P 500 closed down by 0.29%, at 5,618.26 points.

The Dow Jones, closely related to the economic cycle, closed down by 103.08 points, a decline of 0.25%, at 41,503.10 points.

The technology stock-heavy Nasdaq Composite Index (Nasdaq) closed down by 54.76 points, a decline of 0.31%, at 17,573.30 points.

[The following content was updated at 23:11 Beijing time on the 18th] The market is holding its breath, waiting for the Fed's interest rate decision at 2 a.m., with the major U.S. stock indices almost flat: [The following content was updated before 21:50] The first rate cut of this round by the Federal Reserve is imminent, and although expectations for a 50 basis point cut are rising, Wall Street is still debating whether it will be 25 or 50 basis points.

The new "bond king" has spoken in support of a 50 basis point cut, followed by Bridgewater founder Ray Dalio's stance that "a 25 basis point cut is the right move."

Over the next two days, decisions from the central banks of the U.S., UK, and Japan will come one after another.

At 02:00 a.m. Beijing time on Thursday, the Federal Reserve will release the FOMC interest rate decision statement and a summary of the quarterly economic outlook, followed by a monetary policy press conference by Federal Reserve Chairman Powell.

At 19:00 p.m. on Thursday, the Bank of England will announce its policy decision.

On Friday, the Bank of Japan will announce its target interest rate (upper limit).

Today, at the opening of the U.S. stock market, the three major indices were basically flat, with technology stocks rising and falling, the yen strengthening, and international oil prices remaining weak, with Brent and WTI crude oil both falling by about 1%.

[Updated at 21:30] The three major U.S. stock indices opened slightly higher, with the Dow Jones currently down by 0.14%, the S&P 500 down by 0.05%, and the Nasdaq up by 0.03%.

Most Chinese concept stocks rose, with Ke Holdings up by about 2%.

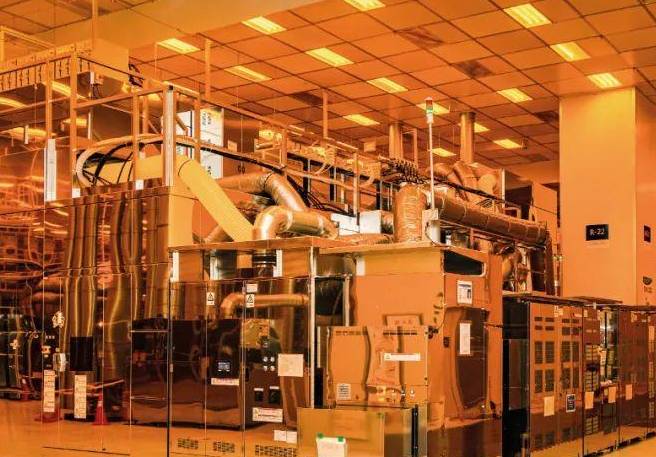

Semiconductor stocks rose and fell, with ASML down by about 1% and TSMC up by 0.65%.

[Updated at 19:40] Spot gold prices rose slightly by 0.3%, at $2,578.20 per ounce.

The bond market fell slightly, with the yield on 10-year U.S. Treasury bonds rising by 3 basis points during the day, and the yield on 10-year UK government bonds rising by nearly 9 basis points during the day.

Earlier data showed that the UK's inflation rate in August remained stable at 2.2%, better than the Bank of England's expectations, increasing expectations for further rate cuts by the Bank of England this year, but the market still believes that the Bank of England may maintain interest rates unchanged this week.

[Updated at 16:35] Today, before the U.S. stock market opened, futures for the three major U.S. stock indices fluctuated narrowly.

Semiconductor stocks rose and fell, with Intel and Micron Technology slightly down, Nvidia slightly up, TSMC up by 0.68%, and ASML down by 0.66%.

Google rose slightly by 0.28% before the market opened, as Google's parent company Alphabet won a lawsuit against the EU's €1.49 billion fine for antitrust in advertising.

Some Chinese concept stocks fell, with Li Auto down by more than 1%.

Major European stock indices opened mostly lower, with the Euro Stoxx 50 down by 0.05%, the German DAX up by 0.07%, the UK's FTSE 100 down by 0.13%, and the French CAC 40 down by 0.03%.

The current trend is as follows: Asian stock indices rose and fell.

The Nikkei 225 closed slightly up, and the Indian stock market fell slightly by 0.2%.

International oil prices remained weak, with Brent and WTI crude oil both falling by about 1%.

The Bank of Japan will decide on interest rates on Friday.

The yen rose by 0.8% at one point, the U.S. dollar weakened slightly, and U.S. Treasury bond yields rose slightly.

Share Your Comment

hare your unique insights