The Chinese yuan has unexpectedly appreciated by 20%!

Doesn't it feel like the bills in your hand have suddenly become heavy, and traveling abroad or shopping online can make you feel like a big spender?

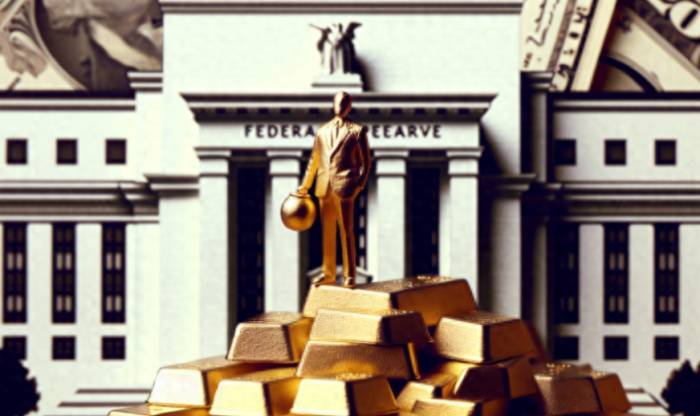

The story begins with the Federal Reserve across the ocean.

This financial "big shot" has invested heavily to tame the beast known as "inflation," raising interest rates so aggressively it's as if money doesn't matter.

As a result, global capital has rushed to the United States like iron filings attracted to a magnet, while other countries' currencies have depreciated like they're sliding down a slide, creating a thrilling sensation that makes your heart pound.

China is an exception, remaining as steady as an old dog, sticking to its own monetary policy without wavering.

Some people are pessimistic about this move, saying the yuan is doomed.

Others praise it as far-sighted.

But what's the outcome?

The Federal Reserve sees that inflation seems to be under control, and rumors of interest rate cuts are on the rise again.

This back and forth has led to a new round of "great migration" of global capital.

This 14 trillion yuan is an astronomical figure, enough to shake the global economy.

Recently, they seem to have collectively agreed to flow back from overseas and rush to China's hot land.

Our economy is stable, the market is vast, and the potential is abundant!

The yuan's exchange rate against the US dollar has risen sharply, falling from the "7s" to the "6s," faster than a rocket.

The two trillion yuan of Chinese capital that was "collecting dust" in US accounts has also begun to speed up its return home, with the corporate settlement ratio dropping to a historical low.

Everyone is waiting for the yuan to appreciate so they can make a fortune.

The appreciation of the yuan has obvious benefits.

Importing raw materials has become cheaper, overseas investments are more confident, foreign investors are flocking in, and economic development is thriving.

Ordinary people traveling abroad, studying, or shopping can basically "go at will," and the money in their wallets lasts longer.

However, there are also challenges.

When the price of exported goods rises, competitiveness weakens, and foreign trade companies cry out that they can't afford it.

Moreover, the influx of hot money also brings the risk of asset bubbles, and one might accidentally "play with fire and burn oneself."

That's what everyone cares about the most.

Theoretically, the appreciation of the yuan should reduce the cost of imports, which may lead to a decrease in prices.

However, the complexity of the actual economic operation often goes beyond this simple logic.

In reality, multiple factors interweave to influence price changes, which are not always directly reflected in exchange rate changes.

When export goods rise in price, domestic prices also start to stir.

Coupled with the influx of capital driving up asset prices, the pressure of rising prices is immense.

Is this price increase a long-term trend or a short-term fluctuation?

It depends on how the global economy plays out.

If the global economy recovers and demand is strong, then rising prices may be the general trend; if it's just a short-term capital flow, it may be a false alarm.

But no matter what, rising prices are a big deal and require the government, businesses, and the public to find ways to cope together.

Let's discuss a few real cases to feel the impact of yuan appreciation on businesses.

For example, a textile export company that was thriving in the international market with a low-price strategy.

After the yuan appreciated, the export cost increased significantly, the price advantage was instantly lost, and the order volume plummeted.

To survive, the company had to transform and upgrade, increasing the added value of its products.

Although the process was difficult, it finally found a new way out.

Another example is a company that imports raw materials.

After the yuan appreciated, the import cost was greatly reduced, and the profit margin was instantly expanded, making the company's boss smile from ear to ear.

Every currency appreciation or depreciation brings a series of chain reactions, but each specific situation is different.

We need to learn from history, but we must also combine it with the current situation to make wise judgments and decisions.

We must return to that core question: has the yuan appreciated, will prices rise?

That's really an unknown.

One thing that can be affirmed is that no matter how prices change, we must remain calm and rational.

The government will strengthen regulation to prevent prices from rising too fast and affecting people's livelihoods.

Companies will adjust strategies to reduce costs and improve efficiency.

What about ordinary people?

We also need to learn financial planning and arrange consumption reasonably.

The "second half" of the yuan's appreciation has already begun, are you ready?

Are you ready to seize the opportunity and make a big move, or are you cautious and waiting to see?

What do you think about this?

Share Your Comment

hare your unique insights