Industrial Profit Growth Accelerates for Two Consecutive Months Data released by the National Bureau of Statistics on the 27th shows that from January to July, the profits of national industrial enterprises above designated size grew by 3.6% year-on-year, accelerating by 0.1 percentage points compared to the January-June period, continuing a stable recovery trend.

In July, the profits of industrial enterprises above designated size grew by 4.1% year-on-year, accelerating by 0.5 percentage points compared to June, marking two consecutive months of acceleration.

Yu Weining, a statistician at the Industrial Department of the National Bureau of Statistics, stated that with the stable recovery of market demand and improved production and sales coordination, the revenue of industrial enterprises has been growing steadily, creating favorable conditions for the continuous recovery of profits.

From January to July, the business income of industrial enterprises above designated size grew by 2.9% year-on-year, with the growth rate remaining unchanged compared to the January-June period.

Looking at different industries, among the 41 major industrial categories, 21 industries saw an acceleration in profit growth rate or a narrowing of the decline compared to the previous month, with more than half recovering.

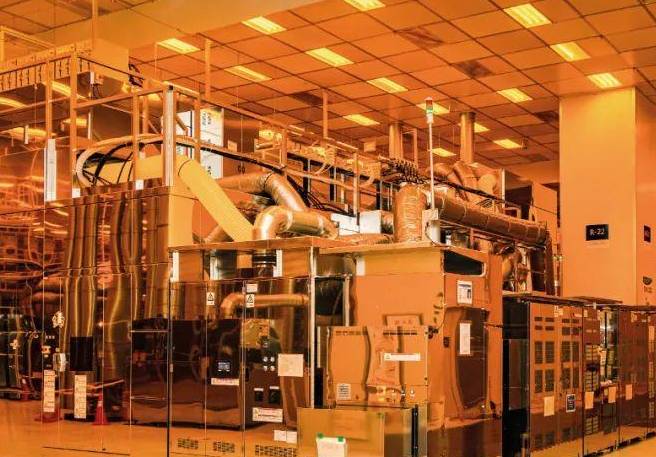

Among them, the high-tech manufacturing industry led the profit growth.

From January to July, the profits of the high-tech manufacturing industry grew by 12.8% year-on-year, significantly higher than the average level of industrial enterprises above designated size by 9.2 percentage points, driving the growth of industrial profits by 2.1 percentage points.

Its contribution rate to the growth of industrial profits is nearly 60%, with a clear leading role.

[Commentary] Analysis suggests that the stable recovery trend of the benefits of industrial enterprises above designated size is mainly due to the dense implementation and effectiveness of stable growth policies, the continuous cultivation and strengthening of new momentum, and the stable industrial production.

This year, industrial production has maintained a relatively fast growth rate, becoming an important force to support the recovery and improvement of China's economy.

In the next phase, industrial profits are expected to continue to improve.

The additional support of 300 billion yuan in special long-term treasury bonds for "two new" areas, along with the 1 trillion yuan in special long-term treasury bonds and special bond funds, will play a positive role in boosting the confidence of industrial enterprises and consolidating the foundation of industrial economic recovery.

Low Fiscal Revenue in the First Seven Months Data released by the Ministry of Finance on the 26th shows that from January to July, the national general public budget revenue was 13.5663 trillion yuan, a year-on-year decrease of 2.6%.

After excluding the special factors such as the deferred tax payment of small and medium-sized enterprises in the same period last year, which raised the base number, and the tax reduction policy implemented in the middle of last year, the comparable growth is around 1.2%.

The data shows that from January to July, the national tax revenue was 11.124 trillion yuan, a year-on-year decrease of 5.4%; non-tax revenue was 2.4423 trillion yuan, a year-on-year increase of 12%.

Looking at specific types of taxes, the domestic value-added tax (4.1 trillion yuan) decreased by 5.2% year-on-year, mainly affected by the high base number of the same period last year and the policy tail reduction; corporate income tax (3 trillion yuan) decreased by 5.4% year-on-year, which is related to the increase in the amount of tax relief enjoyed by enterprises and the significant increase in the amount of losses made up by enterprises during the COVID-19 pandemic.

In terms of land sales income, from January to July, the income from the transfer of state-owned land use rights was 1.7763 trillion yuan, a year-on-year decrease of 22.3%.

The person in charge of the Ministry of Finance stated that this year, affected by special factors such as the deferred tax payment of small and medium-sized enterprises in the manufacturing industry in 2022, which raised the base number for 2023, and the tax reduction and fee reduction policy implemented in the middle of 2023, fiscal revenue has been operating at a low level; in the following months, as macro policies take effect and the economy continues to recover and improve, coupled with the gradual dissipation of special factors, it will support the growth of fiscal revenue.

[Commentary] Experts believe that the slowdown in tax revenue growth this year is not only due to the aforementioned special factors but also related to the slowdown in economic growth.

To make up for the reduction in tax revenue, local governments have revitalized existing assets and resources, and non-tax revenue has maintained rapid growth.

The downturn in the real estate industry has dragged down the performance of related taxes, and local land transfer income has continued to decline.

The constraints on revenue have led to a lower expenditure growth rate than the budget figure.

To complete the fiscal expenditure task for the whole year, it is necessary to provide incremental funds through broad fiscal tools.

It is expected that broad fiscal expenditure will continue to accelerate in the third quarter, providing continuous support for stable growth.

Ministry of Housing and Urban-Rural Development Clarifies Housing Pension Fund Recently, at a press conference, Dong Jianguo, the Deputy Minister of Housing and Urban-Rural Development, stated that they are studying the establishment of a housing health check, housing pension fund, and housing insurance system to build a long-term mechanism for the safety management of housing throughout its life cycle.

Currently, 22 cities including Shanghai are piloting this.

Regarding the housing pension fund, individual accounts already exist through the payment of special maintenance funds for residential housing, and the focus of the pilot is for the government to establish public accounts.

Subsequently, the housing pension fund has sparked heated discussions, with some self-media interpreting it as a "disguised" property tax.

On the 26th, the person in charge of the relevant department of the Ministry of Housing and Urban-Rural Development further explained in an interview with Xinhua News Agency that the housing pension fund consists of two parts: individual accounts and public accounts.

Individual accounts are the special maintenance funds for residential housing paid by the owners, and the payment is carried out according to the current regulations.

The public account, following the principle of "derived from housing, used for housing," and "not increasing personal burden, not reducing personal rights," is established by the government.

From the perspective of pilot cities, local governments can raise funds through fiscal subsidies, land transfer fees, and other ways.

The purpose is to establish a stable channel for housing safety management funds, without requiring residents to pay extra fees, and will not increase personal burden.

The person in charge said that the funds in individual accounts are used for the maintenance, renewal, and transformation of common parts and facilities of residential housing after the warranty period, in accordance with the regulations on the management of special maintenance funds for residential housing.

The funds in the public account are mainly used for housing health checks and insurance expenses.

[Commentary] For a long time, the funds for housing health checks and maintenance have been met through the special maintenance funds paid by the owners.

However, with the advent of the era of existing housing, the proportion of old housing is continuously increasing, and the gap in the housing maintenance fund is increasing.

It is very urgent and necessary to study the housing pension fund system.

According to the official explanation, the housing pension fund system mainly uses public funds and establishes a public account for the housing pension fund, without increasing personal burden.

Experts believe that as a new system with Chinese characteristics, the source of funds for the government's public account and the management model of the housing pension fund need further exploration and clarification.

Personal Payments for Urban and Rural Resident Medical Insurance Increase to 400 Yuan According to the "Notice on Doing a Good Job in the Basic Medical Insurance for Urban and Rural Residents in 2024" announced by the National Medical Insurance Administration and other departments on the 26th, the financial subsidies and personal payment standards for basic medical insurance for urban and rural residents in 2024 will increase by 30 yuan and 20 yuan respectively compared to the previous year, reaching no less than 670 yuan and 400 yuan per person per year.

This is the first time since 2016 that the increase in financial subsidies for resident medical insurance has exceeded the increase in personal payments, and the increase in personal payments by residents has also been appropriately reduced.

In recent years, China's resident medical insurance fund has shown a "tight balance" state.

Data shows that in 2023, the income of the resident medical insurance fund was 1.05697 trillion yuan, and the expenditure was 1.04576 trillion yuan, with a current surplus of 11.206 billion yuan and a cumulative surplus of 766.37 billion yuan.

The person in charge of the National Medical Insurance Administration emphasized that against the backdrop of the continuous increase in life expectancy and the continuous improvement of medical consumption levels, it is an objective need to reasonably increase the standards of personal payments and financial subsidies to consolidate and improve the level of benefits and ensure the smooth operation of the system.

[Commentary] Experts believe that there are two main reasons for the annual increase in resident medical insurance costs: one is the rapid rise in medical expenses, and the other is the rapid improvement in resident medical insurance benefits.

These two aspects have led to the continuous increase in the pressure of expenditures in the urban and rural resident medical insurance fund in recent years.

It is necessary to reasonably increase the medical insurance payment to ensure the smooth operation of the resident medical insurance system.

However, for a small part of the insured, the annual premium of several hundred yuan is indeed a considerable expense.

It is possible to adopt classified policies to ensure the resolution of the basic medical insurance participation problem, such as further increasing the sense of gain for the insured and expanding the scope of the personal account of employee medical insurance to relatives.

Rumors of Existing Housing Loan Interest Rate Cuts Trigger Real Estate Stocks In the afternoon of the 30th, the real estate sector in the A-share market soared, with many stocks once hitting the daily limit.

As of the close, Tefa Service, Gemdale Group, and Tiandi Source all hit the daily limit, Vanke A's stock price rose by 8.33%, Binjiang Group increased by 8.09%, CCCC Real Estate increased by 7.69%, and Xincheng Holdings increased by 7.32%.

In terms of news, there are market rumors that the relevant parties are considering further reducing the interest rates of existing housing loans, allowing the transformation of mortgages with a scale of up to 38 trillion yuan, to reduce the debt burden on residents and boost consumption.

Existing mortgage customers can renegotiate the mortgage interest rate with banks without waiting until January each year, and residents can also directly transfer existing mortgage loans to other banks and sign contracts at the latest interest rates.

Previously, Xuan Changneng, the deputy governor of the People's Bank of China, stated that in 2023, more than 23 trillion yuan of existing housing loan interest rates were reduced, with an average reduction of 0.73 percentage points, saving borrowers about 170 billion yuan in interest expenses per year.

[Commentary] Analysis suggests that at the beginning of August, the six major state-owned banks once again reduced the deposit listing rates, creating room for further reducing the interest rates of existing housing loans.

For example, from September to October last year, banks generally lowered deposit rates, and the central bank carried out a general adjustment of some existing housing loan interest rates.

Currently, the gap between the interest rates of newly issued housing loans and existing housing loans has widened, and there is still room for adjustment.

Recently, many places have successively opened or restarted the "commercial to public" loan business, which has caused heated discussions and echoes the call for reducing the interest rates of existing housing loans.

From the perspective of financial market sentiment, the rumors have had a significant positive effect on real estate stocks.

A series of supports are still continuing, and it is expected that the positive effects will gradually be reflected at the market level.

Management Releases "Pessimistic" Signal, Pinduoduo's Stock Price Plunges On August 27th, Beijing time, Pinduoduo's stock price plummeted by 28.51% at the close of the US stock market on Monday, reporting $100 per share, with a market value of $55.37 billion wiped out overnight.

In terms of news, Pinduoduo's second-quarter financial report released on the 26th did not meet expectations.

The financial report shows that the company's revenue in the second quarter was 97.06 billion yuan, a year-on-year increase of 86%; adjusted operating profit was 34.987 billion yuan, a year-on-year increase of 139%; adjusted net profit attributable to ordinary shareholders was 34.432 billion yuan, a year-on-year increase of 125%.

Previously, the market expected Pinduoduo's revenue to be 99.985 billion yuan.During the earnings call, Pinduoduo's management repeatedly mentioned that the company's profits will enter a downward trend.

Zhao Jiazhen, Executive Director and Co-CEO of Pinduoduo Group, stated that in the fierce competitive environment, Pinduoduo's revenue growth may slow down, and the significant decline in the revenue growth rate in the second quarter also indicates that high revenue growth is actually unsustainable.

Chen Lei, Chairman and Co-CEO of Pinduoduo, said that the general direction of Pinduoduo's gradually declining profits is inevitable.

[Commentary] The real reason for Pinduoduo's stock price plummet is not the earnings data that failed to meet expectations, but the "pessimistic" signal released by Pinduoduo's management during the earnings call.

In fact, compared with e-commerce peers, Pinduoduo's revenue and profits are still in a leading position.

However, in the fierce competitive environment, Pinduoduo's leading advantage is gradually diminishing, and uncertainty is increasing.

The "pessimistic" mood conveyed by the management has caused investors to worry about Pinduoduo's growth prospects.

Analysis suggests that the long-term expansion space for Pinduoduo's monetization rate in the future should come from the improvement of merchants' gross profit margin.

Effectively reducing the operating costs of merchants is the only way for Pinduoduo to create profit margins for merchants, increase investment, and compete with low prices.

Din Tai Fung announces the closure of 14 stores.

Share Your Comment

hare your unique insights